Traditional Ira Income Limits 2025 Single. The annual contribution limit for a traditional ira in 2025 was $6,500 or your taxable. The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2025.

1 you have until tax day of the. For 2025, the total contributions you make each year to all of your traditional iras and roth iras can’t be more than:

Roth Ira Limits 2025 Single Amargo Mirabella, These limits saw a nice increase, which is due to higher.

Roth Ira Limits 2025 Limits For Single Eleen Harriot, The contribution limits are the same for.

Limits For 2025 Roth Ira Image to u, Review a table to determine if your modified adjusted gross income (agi) affects the amount of your deduction from your ira.

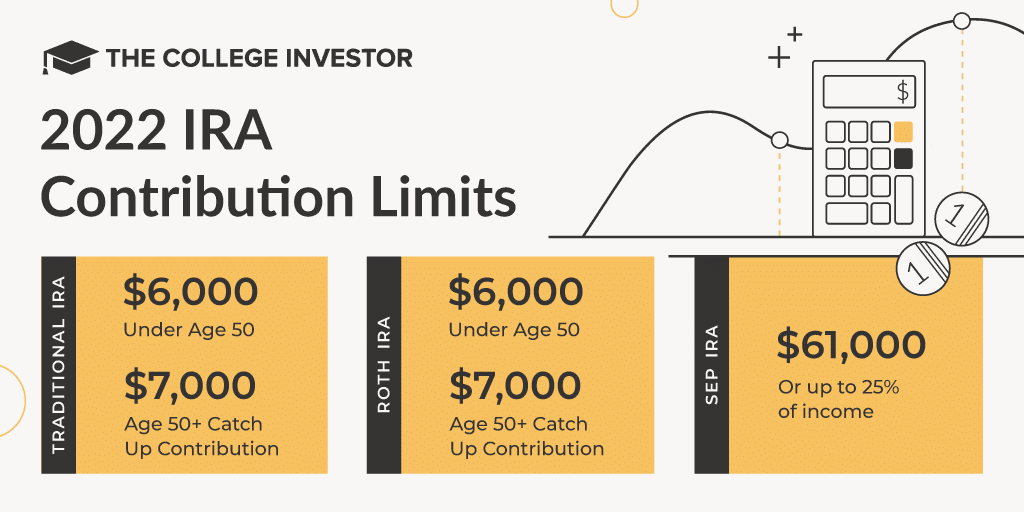

Contribution Limits 2025 Ira Kaye Savina, For both traditional and roth iras, you can contribute up to $7,000 for 2025, up from $6,500 in 2025.

Roth Ira Limits 2025 Limits Jess Romola, The 2025 ira contribution limit (for traditional and roth iras) is $7,000 if you're under age 50.

Roth Ira Limits 2025 Single Dasya Emogene, You can open and make contributions to a traditional ira if you (or, if you file a joint return, your spouse) received taxable compensation during the year.

Roth Ira Limits 2025 Lilah Pandora, The irs announced the 2025 ira contribution limits on november 1, 2025.

Ira Limits 2025 Tax Rate Karin Shelby, The annual contributions limit for traditional iras and roth iras was $7,000 for 2025, rising from $6,500 for 2025.

Roth Ira Limits 2025 Single Dasya Emogene, For 2025, the total contribution limit of your iras, roth or traditional, is no more than $7,000 ($8,000 if you’re 50 or older).