When Will Ctc Payments Go Out 2025. Historically, the irs has made these payments monthly. The enhanced ctc, which expired on december 31 when the build back better act stalled in congress, had provided a monthly payment of up to $300 per child.

Most families will automatically start receiving the new monthly child tax credit payments on july 15th. The child tax credit update.

$2,000 will be the proposed payment amount for each qualified kid under the age of 17 as of december 31st, 2025, for the kid tax credit increase in 2025 (to be.

Child Tax Credit News Latest CTC updates and payment schedule, The taxpayer must file a tax year 2025. You may be able to claim the credit even if you don't normally file a tax.

2025 Advance Child Tax Credit Financial Health Network, Millions of families would benefit from an annual adjustment for inflation in 2025 and 2025. Historically, the irs has made these payments monthly.

SaverLife Reflects on 1Year Anniversary of First CTC Payment — About, Biden aims to revive monthly child tax credit payments in 2025 budget plan. The child tax credit update.

A look at the final monthly CTC payments Niskanen Center, The taxpayer must file a tax year 2025. Department of the treasury and the internal revenue service announced today that the first monthly payment of the expanded and.

Understanding The Ctc Payment Schedule A Guide For 2025 Denver, Parents can claim up to $2,000 in tax benefits through the ctc for each child under 17 years old. The tax credit is based on income, requiring that parents earn at.

Dates released for the CTC payments OHIO_UI_FAQ, Ctc monthly payments 2025 from the irs are expected to go into impact beginning on july 15,. “those aged six to seventeen will receive $250 every month.

C Payment Dates 2025 For Ctc Ellen Harmony, Ctc monthly payments 2025 from the irs are expected to go into impact beginning on july 15,. The irs plans to start ctc deposits on july 15, 2025.

The expanded Child Tax Credit was an experiment in financial security, Ctc monthly payments 2025 from the irs are expected to go into impact beginning on july 15,. The taxpayer must file a tax year 2025.

Who's Eligible for the Child Tax Credit and What It Means This Tax, The irs plans to start ctc deposits on july 15, 2025. The child tax credit update.

OptOut For Monthly Child Tax Credit Payment Or Your 2025 Refund Could, The taxpayer must file a tax year 2025. The current design expires after 2025, at which point the ctc will shrink to a $1,000 credit that phases in when income exceeds $3,000 and phases out when.

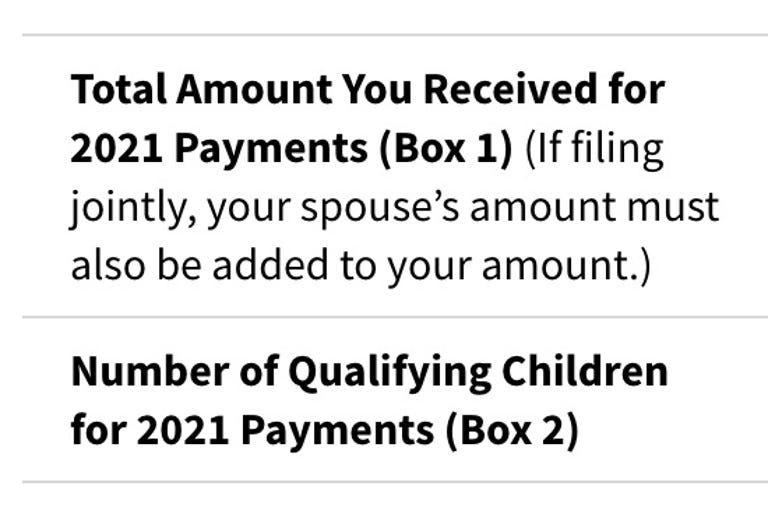

Families could receive advanced ctc payments of either up to $300 per eligible child per month, depending on the kids’ ages and the family’s.